BTO’s and tremors from the subprime mortgage crisis

What are BTO’s or Bespoke Tranche Opportunities?

A BTO is a type of collateralized debt obligation (CDO) that a trader can create for a specified group of investors. These CDO’s are constructed to correspond to the investor’s demands. Then the investor(s) will usually buy a solitary tranche, or portion, of the bespoke CDO. The tranches that remain are then maintained by the trader, who usually endeavor to hedge (invest against losses). The appeal of BTO’s come from the high-risk/high-return they provide for investors.

What are the risks that BTO’s and CDO’s provide?

The housing bubble, which preceded the mortgage crisis, was fueled with mortgage-backed securities (MBS) and collateralized debt obligations that provided higher interest rates and better returns than government backed securities. These investments were followed along by attractive risk ratings from rating agencies.

Tranches of lower priority and higher-interests of MBS were usually repackaged and resold as CDOs. These subprime MBS supplied by investment banks became an offspring of the subprime mortgage crisis of 2007-2008. While the first cracks of the crisis made themselves visible during 2007, various financial organizations collapsed in the wake of September 2008.

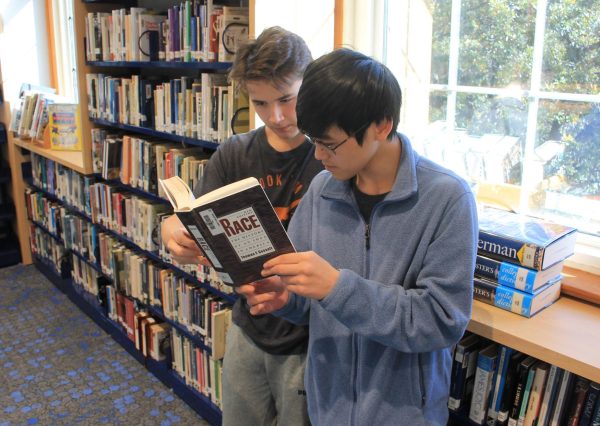

The term subprime refers to the quality of credit in particular borrowers. Subprime borrowers have enfeebled credit histories and a higher rate of loan default than that of prime borrowers. As individuals become more involved economically, records are formulated in relation to earning, borrowing, and lending history (called credit ratings). Although these records are covered by privacy laws, it doesn’t mean that they are entirely unavailable to financial institutions.

Can another mortgage crisis follow as a result?

Perhaps. As schemes that inflated investment ratings made by certain rating agencies have seemed to have lost its touch. The U.S. Securities and Exchange Commission (SEC) stated on August 27, 2014 in a public announcement, written by Commissioner Luis A. Aguilar, that more caution will be required in the future to avoid future crises.

“As a result, new eligibility requirements will replace the investment grade ratings requirements and will require ABS issuers to meet certain transaction-specific and registrant-specific criteria that are designed to ensure that ABS issuers exercise greater oversight and care in making required disclosures,” Aguilar said.

Yet, regardless of the efforts made to protect investors, the public statement also implied that not all measures were met.

“However, even with today’s action, the Commission has not completed its ABS-related work,” Aguilar said. “I believe that asset-level disclosures are important to investors’ ability to make informed investment decisions, and the disclosures provide real transparency to the market about these securities.”

This means that because investors lack the ability to look deeper into what they are buying, the risk of not making returns grows. The only difference between now and prior to the financial crisis is that there is a much higher level of awareness of the risk level involved with these securities.

The problem preceding this crisis was that these securities were marketed and rated by the rating agencies as being AAA quality. These were then purchased by inexperienced investors who were unaware of what they were paying for.

In an interview with Highland Park High School’s Athletic Trainer and Senior Class Sponsor, Jay Harris, he was asked whether he believed the mortgage crisis would happen again.

“Yes I do, and I think can happen the same way,” Harris said. “And I think a lot of people don’t realize when you have the opportunity to buy your first house, it doesn’t matter what your economic status is, or what your financial status is. It is such an exciting time in your life, and you just want it to go through, approved for your first house and have ownership and sometimes banks take advantage of that.”

Harris explained that he believed a major error was that several buyers were unaware of what their mortgages entailed.

“[Buyers] totally [don’t] understand what exactly your mortgage is made up of,” Harris said. “Is there a five years ARM? You usually don’t find higher than a five year ARM.”

Harris continued, saying that the exact meaning of these complex mortgages is lost on many consumers.

“But do you really know what that means,” Harris said. “And was all of that explained to you? The difference between a five year [ARM], a fixed and a variable interest rate?”

This concern implies an ability of individual’s emotions being played upon by financial institutions; placed in a scenario where they gain the house of their dreams yet they are faced with mortgages they can not pay over time. With that, these same institutions can package these mortgages and sell them to unsophisticated investors.